charitable gift annuity tax reporting

The charitable interest equals the. It will pay her 800000 a year or 40 a year for the rest of her life.

Send the Gift Annuity Application to the Gift Planning office at Columbia.

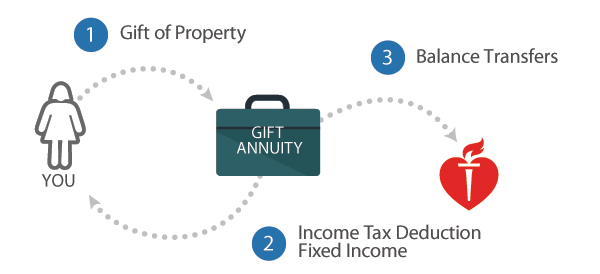

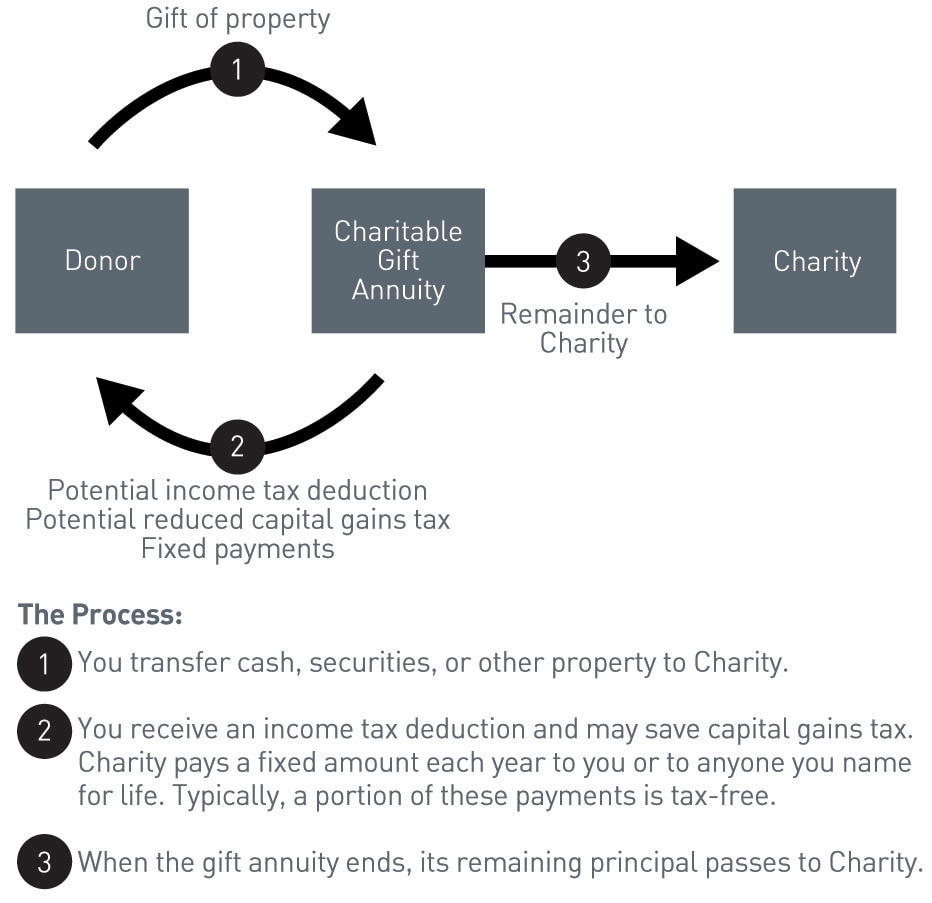

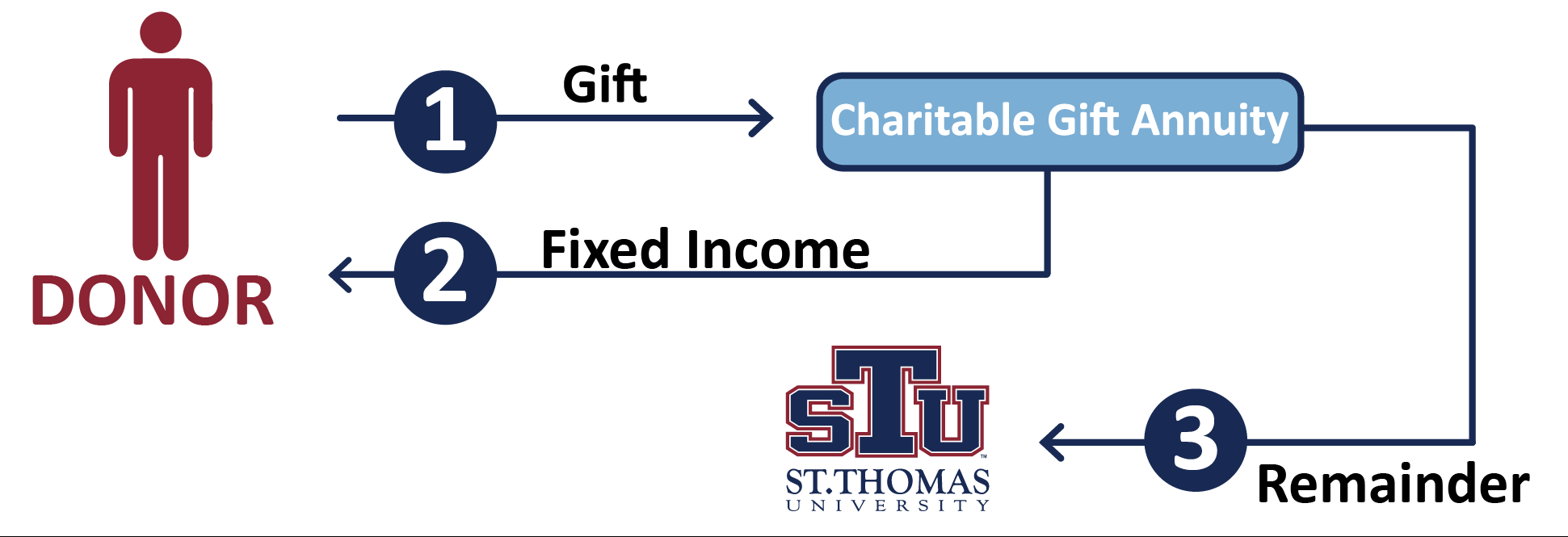

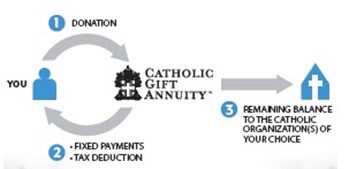

. A charitable gift annuity is a way you can make a gift to your favorite charity and receive fixed payments for life in return. A charitable gift annuity allows you to eliminate capital gains tax when you donate long-term appreciated assets including non-income-producing property. The deduction is calculated by taking the full gift amount and subtracting the present value of all the annuity payments.

As with any other lifetime. You paid 100000 for the annuity. 282 holds that if a donor makes a gift to a charitable organization and in return receives an annuity from the charity payable for his or her lifetime from the general.

For the 2021 tax year cash contributions up to 600 can be claimed on Form 1040 or 1040-SR line 12b. Annuitants interest when annuitant. The taxation breakdown is as follows.

If you are using a check to fund the gift enclose your check with the application. Tax deductions for charitable gift annuities depend on the number of beneficiaries and the age of the beneficiaries at the time. Enter the total amount of your contribution on line 12b.

The income tax charitable deduction for a gift annuity is less than the amount of the gift donated. She has 2000000 to invest in the annuity. You deduct charitable donations in the.

Finally under Reg Sect 256019-1f even if no tax liability is owed on the gift return because of application of the charitable deduction the Form 709 will still be required. At age 65 the rate is 47 and at age 70 it goes up to 51. That is a portion may.

Shortly after your application is. How Taxes Deductions on Charitable Gift Annuities Work. Dont enter more than.

That makes sense when you consider only part of the gift annuity is a gift to your. This calculation is usually done by the charitable. Jones also desires to make a gift to her favorite charity.

Its then deductible resulting in a wash. Youll need to sign. A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity.

Charitable Gift Annuity. If you and your. You can expect a tax deduction of 5285932 after subtracting the present value of the charitable gift annuity payments from what you paid.

Up to 25 cash back For 2013 the ACGA suggests that a 55-year-old be guaranteed a 4 annual return. Shortly after your application is received you will be sent a Charitable Gift Annuity Agreement along with tax reporting information for when you file your income taxes. The payments can begin immediately or can be.

The non-charitable interest in the 50000 gift principal is equal to the investment in contract 3347450. January 28 2020 659 AM. A gift annuity is deducted as a charitable donation a component of itemized deductions.

The charitys gift is a present interest gift and is reportable if it exceeds the 13000 annual exclusion.

Charitable Gift Annuity National Gift Annuity Foundation

Gifts That Pay You Income American Heart Association

Gift Annuity Offers Tax Break And Retirement Income Kiplinger

The Gifts That Keep On Giving 5 Strategies To Tax Optimize Charitable Giving

Key Differences Between Charitable Gift Annuities And Endowments Pnc Insights

National Gift Annuity Foundation Guidestar Profile

Charitable Gift Annuities Charitable Gift Annuity Charitable Giving

Less Is Often More Tax Issues With Charitable Gift Annuities

Charitable Gift Annuity Giving To St Lawrence

Charitable Gift Annuities Office Of Philanthropy St Thomas University

Gift Annuity State Registration Crescendo Interactive

What Is A Charitable Gift Annuity Thrivent

Charitable Gift Annuities Natural Resources Defense Council

Charitable Gift Annuity Claremont Mckenna College

The Law And Taxation Of Charitable Gift Planning An Online Series Marketsmart

Charitable Gift Annuity Priests Matching Program Catholic Extension

The Gift That Pays You Income Diocese Of Sioux City Sioux City Ia